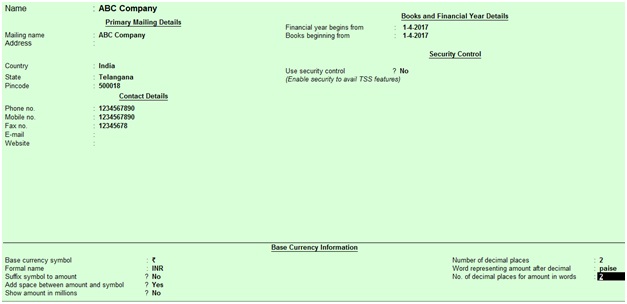

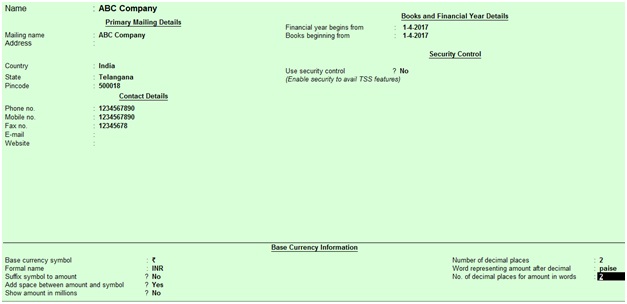

- HOW TO CREATE A NEW COMPANY IN TALLY ERP 9 WITH GST SOFTWARE

- HOW TO CREATE A NEW COMPANY IN TALLY ERP 9 WITH GST PROFESSIONAL

We will also courier you DVD on your registered address within 7 to 15 days depending upon geography.

You can download all Contents and access it offline. It will have eLearning Videos and eBook (PDF Material). Once you make Fees Payment, we will send you Download Link within 24 working hours.

Masters – Bill wise Debtors and Creditors Ledgerįrequently Asked Questions : How will I get Training ?.

HOW TO CREATE A NEW COMPANY IN TALLY ERP 9 WITH GST SOFTWARE

Business Owners :- Even if a business owner or top management don’t do data entry work in tally, then need to have knowledge of Tally Software so that they can analyze data, keep an eye on cash and fund flows, profits, finance, reporting and other valuable information that helps them in Decision Making. Commerce Students :- Every commerce students must learn Tally ERP 9 Online Course with GST, because majority of Indian Small and Medium Businesses use Tally ERP9 for their Day to Day Accounting work. HOW TO CREATE A NEW COMPANY IN TALLY ERP 9 WITH GST PROFESSIONAL

Accountants :- Accounting Job Persons, Tax Consultants, Chartered Accountants, Cost Accountants, or any other professional who need to work on Tally Software. Anyone :- who wants to learn and perform accounting, inventory and taxation work on Tally. Who Can Join Tally ERP 9 Online Course with GST? Learn Complete Accounting and Taxation System with Industry Experts. We not only teach the concepts but also helps you learn how you can Practically implement those concepts in your Day to Day Accounting Process with practical examples and entries in tally.

Tally ERP 9 Online Course with GST covers in-depth knowledge to meet the accounting requirements of the industry.

0 kommentar(er)

0 kommentar(er)